Introduction: The $4/Day Mining Myth 💡

When I first got into crypto mining in 2018, I heard people say, “You can easily make $5–$10 per day per machine.” Back then, it sounded simple. Buy hardware, plug it in, and watch the cash flow in.

Fast forward to 2025, and many beginners are asking me: “Can I still make at least $4/day mining?”

The truth is — it depends. Mining profitability is shaped by more than just hashrate. Electricity rates, hardware efficiency, and crypto price swings all determine whether $4/day is realistic or just hype.

This is where I lean heavily on ASICProfit, a real-time profitability calculator for crypto mining hardware. Instead of guessing, it shows me the numbers that matter: daily earnings, power cost, and ROI.

So let’s put ASICProfit to the test and find out: Is $4/day still achievable in today’s mining world?

The Problem With “Flat Profit” Thinking ❌

Many new miners make the mistake of assuming all hardware is profitable the same way. But mining doesn’t work like that.

Here’s what actually determines profit:

- Hardware efficiency (watts per terahash)

- Your electricity cost per kWh

- Coin market prices (Bitcoin, Kaspa, Aleo, etc.)

- Mining difficulty adjustments

- Uptime & cooling setup

This means two people can buy the exact same miner — yet one makes $4/day while the other loses money.

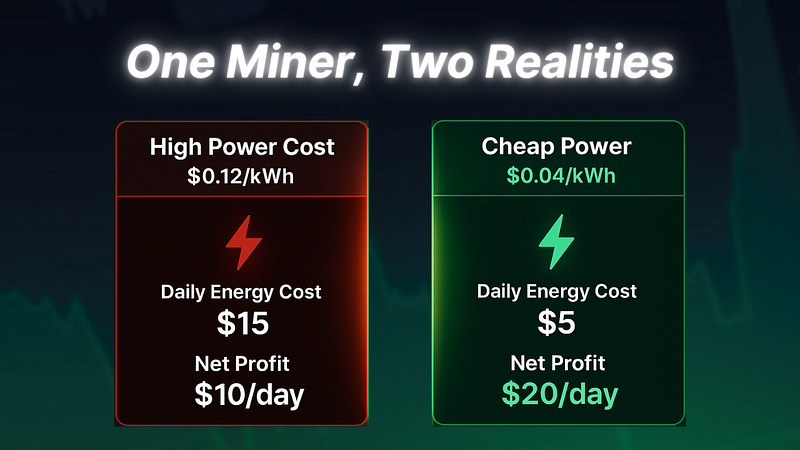

Example: One Miner, Two Realities ⚡

Let’s run the numbers using ASICProfit with a 5,000W ASIC miner earning around $25/day gross.

Scenario A — High Power Cost ($0.12/kWh)

- Daily energy cost: ~ $15

- Net profit: $10/day

Scenario B — Cheap Power ($0.04/kWh)

- Daily energy cost: ~ $5

- Net profit: $20/day

👉 Same hardware, same gross earnings — but double the net profit simply by changing power cost.

This is why the question “Can I make $4/day?” doesn’t have a universal answer. Instead, it’s about your setup.

Where $4/Day Actually Fits In

Here’s the honest truth:

- If you’re running entry-level hardware or older miners, $4/day net profit may be the best you can expect.

- If you’re using newer, efficient crypto mining hardware with cheap hosting, $4/day could be on the low end of your results.

- In some cases, miners on home power (above $0.12/kWh) might struggle to even hit $4/day after electricity bills.

When I check ASICProfit, I can instantly see which miners fall into that $4/day “borderline zone.” That helps me avoid disappointment.

Why ASICProfit Is My Go-To Tool

I don’t say this lightly: ASICProfit has saved me from making bad purchases more times than I can count. Here’s why:

1. It factors in power cost automatically ⚡

- No more guesswork. You type in your kWh price, and the calculator updates instantly.

2. It shows net profit, not just gross 💸

- Too many websites focus on “what the miner earns” without subtracting costs. ASICProfit does both.

3. It calculates ROI in days ⏳

- Before I buy, I always check how long it will take for a machine to pay itself off.

4. It updates in real time 📊

- Coin prices and network difficulty change daily. ASICProfit keeps me current.

👉 You can try it for yourself here: ASICProfit

Breaking Down the $4/Day ROI ⏳

Let’s imagine you spend $1,200 on a smaller ASIC miner.

- If it nets $4/day:

- ROI = 300 days (~10 months)

- If it nets $8/day:

- ROI = 150 days (~5 months)

This is why I always tell beginners: Don’t dismiss $4/day as “too low.” For affordable hardware, it can still mean payback within a year. The real question is: How stable will that $4/day remain?

Real Talk: My Experience With “Small Profit” Mining 💬

Back in 2020, I ran a small batch of older air-cooled miners. Each one made about $3–$4/day. Friends laughed, saying it wasn’t worth it.

But here’s what happened:

- Over a year, those “small profits” added up.

- I reinvested into newer, more efficient crypto mining hardware.

- Some of the coins I mined went up in value, doubling my returns.

The lesson? Sometimes steady, small profits compound into big wins — especially if you hold your mined coins instead of instantly selling.

What Beginners Should Ask Themselves 🤔

Before chasing any miner, ask yourself these three questions:

1. What’s my electricity cost?

- If it’s above $0.12/kWh, home mining may not be worth it.

2. Am I okay with smaller profits at first?

- $4/day may sound low, but it can scale and compound.

3. Do I have a long-term plan?

- Are you reinvesting profits? Holding coins? Using hosting providers?

The answers will guide whether $4/day is acceptable — or if you should aim higher.

Why Hosting Can Change Everything 🌍

One of the biggest trends in 2025 is hosted mining. Instead of running machines at home, miners send hardware to facilities with industrial power rates (as low as $0.04–$0.06/kWh).

At these rates, even modest miners cross the $4/day mark easily. This is why I recommend beginners at least consider hosting instead of fighting high home power costs.

The Bigger Picture: $4 Today, More Tomorrow 📈

Here’s a key insight I’ve learned:

Mining isn’t about what you earn today — it’s about what those coins will be worth tomorrow.

If Bitcoin or Kaspa doubles in value next year, your $4/day could retroactively become $8/day in terms of ROI. That’s why profitability calculators like ASICProfit are so powerful: they give you the numbers now, so you can plan for the future.

Conclusion: So, Can You Really Make $4/Day Mining?

Yes!, but the real answer is: It depends on your setup.

- With high power costs and older crypto mining hardware, $4/day may be the max you’ll see.

- With efficient miners and cheap electricity, $4/day is just the starting point. You could be earning $10, $15, even $20 per day.

- Either way, the key is to use ASICProfit before you buy, so you know exactly what to expect.

Final Takeaway 💡

Mining isn’t a “get rich quick” game — it’s a numbers game. The difference between profit and loss often comes down to a few cents per kWh.

That’s why I never make a purchase without checking ASICProfit.

Because whether you’re making $4/day or $40/day, knowledge is the real power in crypto mining.

🔗 Stay Connected

🎥 YouTube