Introduction: Why I Never Buy a Miner Without Checking First 🔎

When I first got into mining back in 2018, I made a classic rookie mistake: I bought hardware purely based on hashrate hype. The seller pitched it as “the best miner of the year,” but I never checked actual profitability with my local energy cost. Within months, my profits evaporated.

Fast-forward to today, and I can confidently say: I don’t purchase any crypto mining hardware without first checking ASICProfit.

If you’re serious about mining — whether you’re just getting started or running a farm — you need a way to calculate ROI, daily earnings, and energy impact before committing thousands of dollars. That’s exactly what ASICProfit delivers.

In this post, I’ll explain why it’s the tool every miner should bookmark, and how it can help you avoid bad purchases, save money, and maximize profits.

The Hidden Trap of Buying Miners Blind

Crypto mining hardware has evolved fast. We’ve gone from GPUs to ASICs specialized for Bitcoin, Kaspa, Aleo, Dogecoin, and more. But there’s one constant: hardware alone doesn’t guarantee profit.

Here’s why many miners lose money:

- They ignore energy costs. A $10/day gross profit miner might be unprofitable at $0.12/kWh.

- They don’t check real ROI. Hardware that looks affordable can take 2+ years to break even.

- They chase trends. Buying the “hottest miner” without checking numbers often ends in disappointment.

- They miss market timing. Profitability changes daily based on coin prices and difficulty.

👉 I’ve been burned by every one of these mistakes — and that’s why ASICProfit became my go-to.

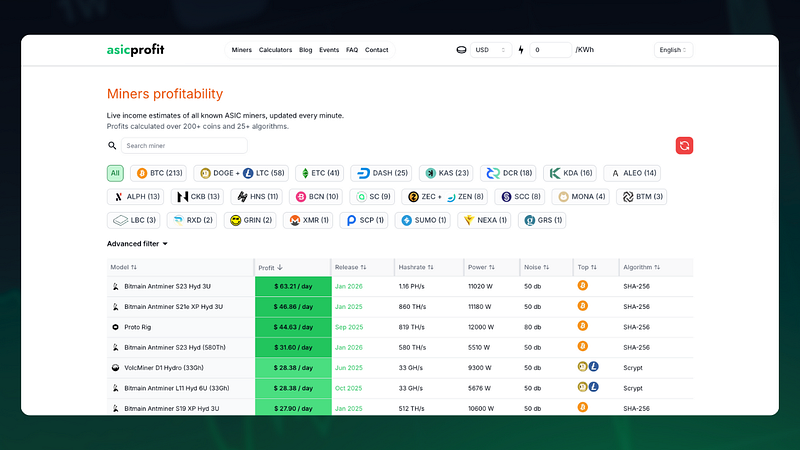

What Is ASICProfit? 🖥️

ASICProfit is a real-time profitability tracker for crypto mining hardware. It lets you:

- Search miners by model (e.g., Antminer S21, IceRiver KS3M, Jasminer X4)

- See real-time revenue, power usage, and net profit

- Adjust electricity rates to match your setup

- Compare miners side by side before you buy

- Calculate ROI in days or months

Instead of spreadsheets, guesswork, or outdated YouTube reviews, ASICProfit gives you live, accurate data.

Why ASICProfit Beats “Gut Feeling”

Over the years, I’ve learned that buying miners based on gut feeling is a gamble. ASICProfit flips the script with data-driven decisions.

Here’s what I like most:

1. Customized Energy Rates ⚡

Enter your exact kWh rate. Whether you pay $0.04 hosting in Nigeria or $0.12 at home in New York, you’ll see accurate daily cost impact.

2. Net Profit, Not Just Gross 💸

Too many sites only show gross revenue. ASICProfit always factors in electricity, giving you the true net earnings.

3. ROI Calculator 🕒

Instantly see how long it takes for your miner to pay itself off.

4. Comparisons Made Easy 📊

Put multiple miners side by side to decide which one fits your budget and power setup.

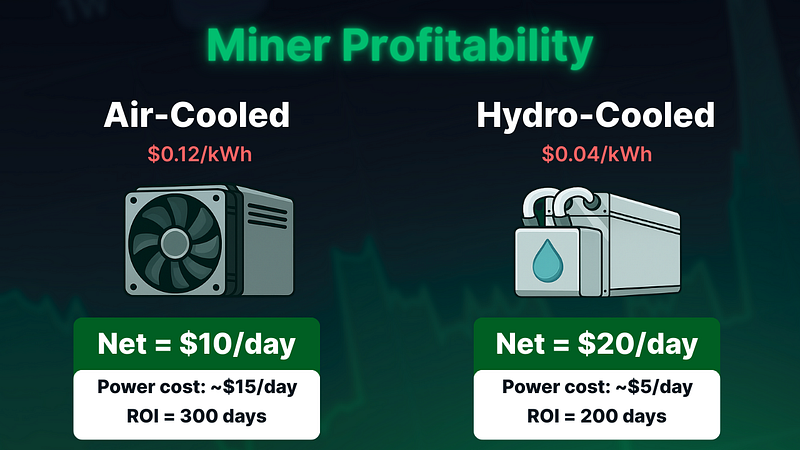

Example: Air-Cooled vs Hydro-Cooled Miner Profitability

Let’s run through a quick example using a 5,000W ASIC miner earning $25/day gross.

- Air-Cooled Setup (at $0.12/kWh):

- Power cost: ~$15/day

- Net = $10/day

- ROI on $3,000 unit = 300 days

- Hydro-Cooled Setup (at $0.04/kWh):

- Power cost: ~$5/day

- Net = $20/day

- ROI on $4,000 unit = 200 days

👉 Without ASICProfit, it’s easy to miss that hydro + cheap power beats air-cooling long term — even if it costs more upfront.

How Beginners Benefit from ASICProfit 🧑💻

If you’re new to crypto mining hardware, ASICProfit is your best friend. It:

- Saves you from buying noisy, unprofitable miners.

- Shows real ROI so you know what to expect.

- Helps you understand why hosting providers with $0.04–$0.06/kWh rates can double profitability.

- Gives you confidence before spending thousands of dollars.

When I mentor beginners, the first tool I point them to is always ASICProfit.

How Professionals Benefit from ASICProfit 🏭

Even large-scale miners rely on constant monitoring. ASICProfit helps pros:

- Compare dozens of models before bulk orders.

- Adjust strategies as coin difficulty changes.

- Evaluate ROI for different hosting regions.

- Spot trends (e.g., when Kaspa miners outperform Bitcoin rigs).

For me, it’s not just a tool — it’s part of my daily routine.

Why ASICProfit Should Be Your First Stop

Every miner purchase is an investment. And like any investment, you need research before pulling the trigger.

ASICProfit gives you:

- Transparency

- Accuracy

- Confidence

Without it, you’re guessing. With it, you’re making informed decisions that could save or earn you thousands.

My Rule of Thumb Before Every Miner Purchase ✅

Here’s the checklist I personally follow before buying any miner:

- Search model on ASICProfit

- Input my hosting electricity rate

- Check net profit per day

- Compare ROI vs alternative models

- Decide if the miner fits my long-term strategy

If a miner doesn’t pass this test — I don’t buy it. Simple as that.

Conclusion: Don’t Mine Blind

Crypto mining is competitive, and margins can be thin. I’ve learned the hard way that buying miners without checking profitability first is a gamble.

That’s why ASICProfit isn’t just a nice-to-have — it’s a must-have. Whether you’re running a home setup or scaling to a hundred machines, make it your first stop before every purchase.

👉 You can try it here: ASICProfit

Final Takeaway 💡

The smartest miners don’t just buy the latest hardware — they buy the hardware that’s profitable for their energy setup and ROI timeline.

And the easiest way to figure that out? ASICProfit.

🔗 Stay Connected

🎥 YouTube